With a slight uptick in inventory and the number of listings on the rise every week, buyers are hopeful about the spring market this year. Is this change a sign of things to come?

The month of March saw the first dip in pricing in months. With the average price in the Waterloo Region last month falling to $957,084, down 5.96% from the all time high it had reached in February, though still up slightly from the beginning of the year.

There are other signs of change in the marketplace. Many Realtors report less offers on offer day and with this decrease in competition some offers are once again being accepted with conditions.

That said, one month of data doesn’t make a market and it is too soon to confirm it as a trend. The median sales price over the last year has steadily increased when looking at a 12-month rolling average. Detached homes are selling for a median price of $880,000 over the past 12-months, up 25.7 percent from the previous 12 month period and attached homes saw a 29.9 percent to $623,750 during that time. While inventory has climbed slightly, our current supply sitting at 3 weeks, we are still a long way from the balanced market buyers are hoping for. Many experts are still predicting 2022 to be another year of overall gains for most homeowners in the country, albeit more modest than the past couple years.

Despite the Bank of Canada’s announcement at the beginning of March that increased rates, we are still in a historically low rate environment. These low rates combined with a historic shortage of housing supply continue to fuel a heated real estate market from coast-to-coast. Nationally, sales prices are growing at the fastest rate ever, with the national average sale price rising 21% over the past year to $816,720. The Aggregate Composite MLS® Home Price Index was up a record 29.2% on a year-over-year basis, exacerbating concerns about affordability.

The Consumer Price Index (CPI) rose to 5.7% as of last measure, marking the first time since 1991 inflation has topped 5%, with shelter costs increasing 6.6% year-over-year, the fastest pace since August 1983, according to Statistics Canada. The latest data from the Labour Force Survey found wages increased 3.1% over the same period, further decreasing purchasing power and putting additional strain on Canadians amid growing affordability concerns. For the 12-month period spanning April 2021 through March 2022, the average property sold in 12 days for 117.4% of asking price.

Please let us know if you would like a more detailed report on a specific property, this is a service we are always happy to provide, free of charge.

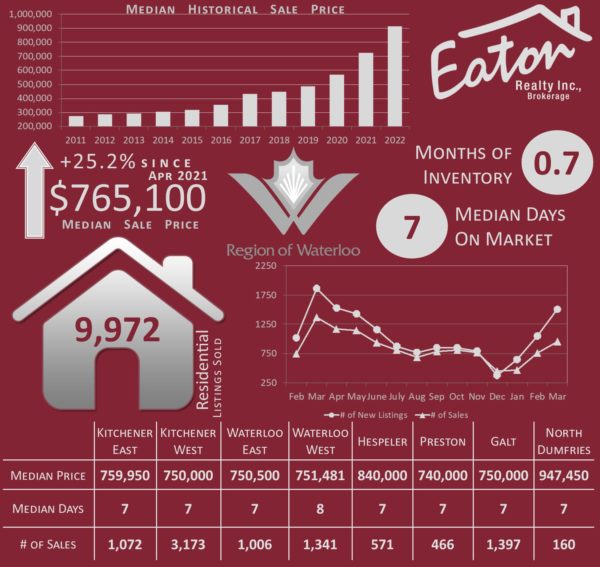

The Median Historical Sale Price in the graphic represents year-to-date value.

All other values represent a 12 month rolling average as of March 31, 2022.