The Canada housing market downturn may be easing up, and recent data from the Royal Bank of Canada (RBC) suggests the Bank is feeling increasingly optimistic about the future of the market.

The Canada housing market downturn may be easing up, and recent data from the Royal Bank of Canada (RBC) suggests the Bank is feeling increasingly optimistic about the future of the market.

In March, RBC announced a conditional pause on interest rate hikes, marking the first time in over a year that rates have not increased. Although home prices remain elevated by historical standards, the Bank’s decision should help ease fears of additional rate hikes in the short term and encourage some buyers to return to the market, with home sales expected to increase as the year progresses.

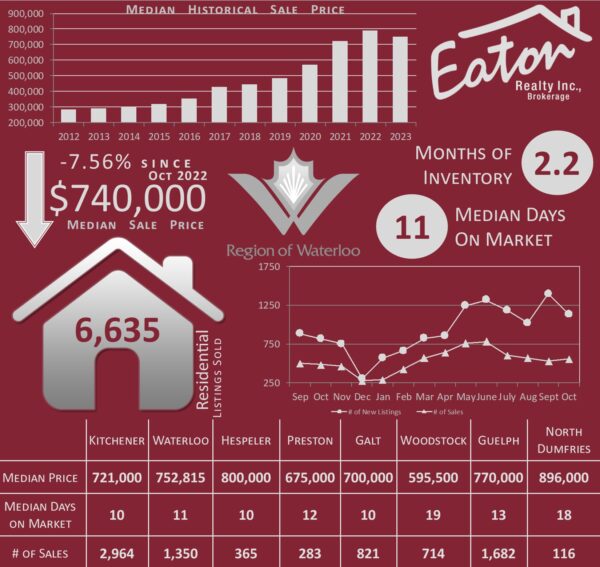

“Sales are trending up, markets have tightened considerably, the Bank of Canada is on hold, and the MLS® Home Price Index is stabilizing across the country. That said, the supply issue is still with us. New listings are at 20-year lows.” said CREA’s Senior Economist, Shaun Cathcart. The same holds true locally, with a 50% decrease in the number of new listings year over year keeping inventory levels depressed. For the first time in 2023, we have less inventory than we did in the same month of 2022.

Despite the lack of new properties coming on to the market, sales activity has begun to pick up, with national home sales rising 2.3% month-over-month as of last measure, according to the Canadian Real Estate Association (CREA). Locally, the number of sales increased by 12.5% from March to April with 640 sales reporting a median price of $763,550, a price increase of 5.3% from the previous month.

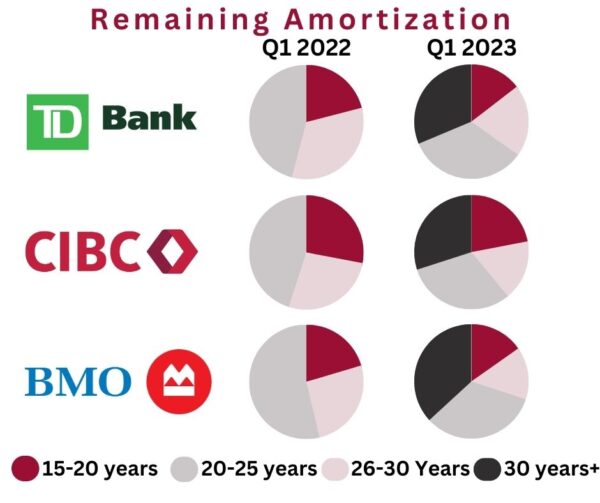

Interest Rate Increases Have Added Years to Mortgages. A real estate trend to monitor closely in the coming years is the increase in amortization periods, as higher rates have pushed that mortgage free day out by years for many homeowners.

As interest rates rose while the Bank of Canada tried to tame inflation, those with variable rate mortgages saw one of two things happen. Either the monthly payment increased to cover the higher cost of borrowing, or they were in a product with a variable rate but a fixed payment, wherein the payment stays the same but the portion being paid toward principal declines to cover the increased interest costs. For some the entire monthly payment now goes towards interest resulting in negative amortization, thus extending the amount of time it will take to pay off the mortgage by years.

In Q1 of 2022 BMO reported that 0% of their mortgages had amortizations in excess of 30 years, in Q1 of 2023 that number had soared to 32.4% of its $142 billion mortgage portfolio. CIBC and TD saw a similar increases to 30% and 29% respectively.

So what does this mean for the borrower? As interest gets added onto the principal owing that time horizon for paying the balance off extends, but this can’t go on indefinitely, Canadian mortgages have terms, typically 5 years, at the end of the term you have to renew.

Michael Rhodes, group head of personal banking at TD, explained that at renewal clients, will be required to increase their payments in order to bring their amortization back down to what it should be (25 years). “The contractual obligations haven’t changed for the customer. And so, if [they have] a 25-year term, even if they may be amortizing currently at a slower rate, they still do have a 25-year term,” he said. “When the renewal comes, we are generally looking to either reset to the initial term or possibly re-underwrite for, let’s call it, a new 25-year term.” Translation, the total amount owing including all that extra interest that was racked up now needs to be recalculated to span a shorter period of time, which means higher payments.

When asked about these mortgages during BMO’s Q1 Conference call, Piyush Agrawal, BMO’s CRO said “… it’s not for us to tell them to pay more now. The product allows them to pay as and when they are able. Several customers have taken us up, and 20% have actually put more money in, but we think that the average increase, by the time of renewal, is absolutely manageable for our customers. In fact, it gives them the optionality because many of them, like us, do believe rates will come down. When it comes time for renewal, which the big slug for us is three or four years out, we should be in a very healthy position and actually build customer loyalty. None of those negative mortgages, by the way, have hit any regulatory trigger rate. We feel that we are in a very good position with our customers.”

It should also be noted that this doesn’t apply to all banks, both Scotiabank and National Bank report no significant changes to their portfolios amortization schedules.

If you are in a fixed payment, variable rate mortgage, or if you aren’t sure, consider reaching out to your mortgage professional. If you don’t have one, we have great contacts in the industry, please give us a call.

As home prices decline, if your mortgage balance at renewal exceeds the appraised value of your property, your choice of lender and rate may be quite limited. As with most things in life getting out in front and dealing with things from a position of strength will usually provide better results. If you can afford to, take advantage of any prepayment privileges you have in your mortgage, this can save you tens of thousands of dollars on its own and can also provide better options at renewal.

Statistics compiled from information available on the ITSO Database as of April 30, 2023. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.