After months of declining, the number of home sales rose slightly nationally. Representing the first such increase since March 2021, when home sales set an all-time record, according to the latest data from the Canadian Real Estate Association (CREA). The Government of Canada bond yield is accelerating, and mortgage rates are on the rise, with experts expecting further rate hikes into 2022. While increasing rates may sideline some potential buyers, others may be motivated to lock in their home purchases before the window of opportunity closes.

After months of declining, the number of home sales rose slightly nationally. Representing the first such increase since March 2021, when home sales set an all-time record, according to the latest data from the Canadian Real Estate Association (CREA). The Government of Canada bond yield is accelerating, and mortgage rates are on the rise, with experts expecting further rate hikes into 2022. While increasing rates may sideline some potential buyers, others may be motivated to lock in their home purchases before the window of opportunity closes.

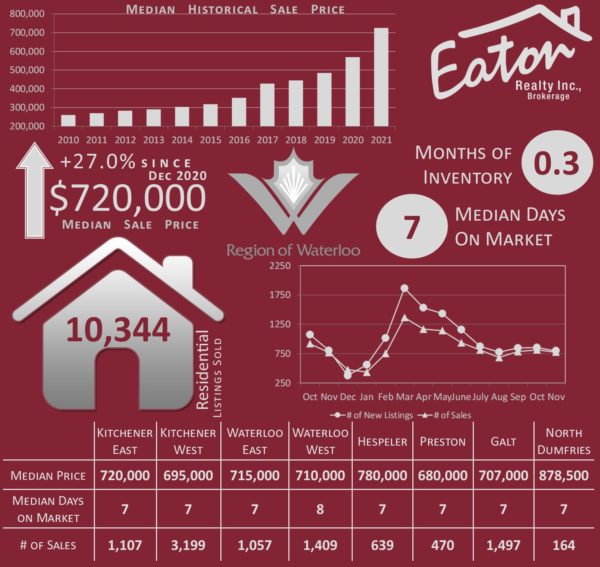

In the Region of Waterloo the median sales price over the past 12 months has increased 26.15 percent to $820,000 for detached homes and 30.26 percent to $580,000 for attached homes from the previous 12 month period. Other market trends are also continuing; region wide in the month of November the average property sold in just 13 days for 114.8% of its listed price and our current supply of inventory sits at just 1.3 weeks.

A rush of new jobs in recent months has helped Canada’s economy exceed pre-pandemic levels, as jobless claims are now at their lowest rate since February last year. The relative steadiness of new listings and closed sales recently is leading some to speculate that the pandemic-related volatility of the housing market may be a thing of the past. However, with housing price increases exceeding the growth in households’ borrowing ability, declining affordability remains a large concern among buyers and government officials alike.