Higher interest rates continue to put downward pressure on home prices, with the MLS Home Price Index (HPI) dropping by 1.2% month-over-month, according to CREA.

Higher interest rates continue to put downward pressure on home prices, with the MLS Home Price Index (HPI) dropping by 1.2% month-over-month, according to CREA.

Nationally, home prices have declined for 8 consecutive months, with the average selling price down more than 20% from the peak in February. The decline in home prices hasn’t done much for affordability, however. The Bank of Canada has increased its policy rate by 350 basis points to 3.75% this year, and soaring borrowing costs have made monthly payments too expensive for many prospective homebuyers.

Higher home prices and rising interest rates have continued to push many would-be buyers toward the rental market, where demand for rental units is surging. According to Rentals.ca, national rents for all property types rose 11.8% year-over-year to an average of $1,976 as of last measure, with rents up an average of $209 per month compared to the same period a year ago, and $130 per month higher than the pre-pandemic high of $1,845 in October 2019.

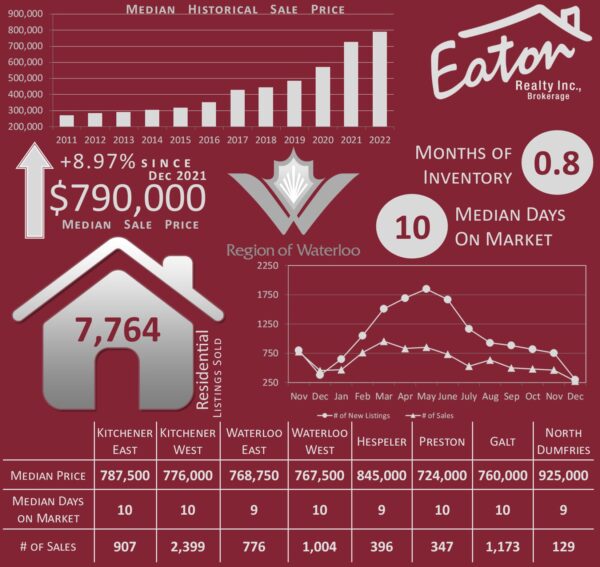

The median sale price in the Waterloo region remains relatively steady over the past several months, currently at $790,000 during the previous 12-month period. Other trends are also continuing, such as a steady decline in market activity. The number of new listings is down 21.4% compared to December of 2021 while the number of sales has plunged 40.3% with 184 fewer sales last month than there was in December of 2021.

This less competitive market is also translating into a decrease in the list to sale price ratio. During the height of the Sellers’ market of 2020/2021 properties frequently sold for 100’s of thousands over the asking price. In fact, it was rare for a property to sell below its listed price. Over the last 90 days the median list to sale price ratio has continued to trend downwards and has consistently been below 100%, meaning more homes are selling at prices below asking than above.

Looking forward to 2023 there are a number of new government initiatives that target the housing sector including:

– First-Time Home Buyer’s Tax Credit (HBTC) for the 2022 and subsequent tax years

– Tax-Free First Home Savings Account (FHSA)

If you have a young adult in your house this is something to look into!

-Two-Year Ban on Non-Canadians Purchasing Residential Property

Coming into force today (January 1, 2023)

– Multigenerational Home Renovation Tax Credit

claim up to $7,500 to build a secondary unit in their home to accommodate seniors or adults with disabilities

– Residential Property Flipping Rule

Profits arising from dispositions of a residential property (including a rental property) that was owned for less than 12 months would be deemed to be business income and as such subject to full taxation.

Statistics complied from information available on the ITSO Database as of December 31, 2022. Unless otherwise stated numbers refelct the previous 12 month period.