Rising interest rates may ease competition as inventory continues to climb, but those increasing costs are likely to worsen affordability.

In April, the Bank of Canada increased its key interest rate by 50 basis points to 1.00%, as officials attempt to tame inflation, currently at a three-decade high. Today, the next Interest Rate Announcement is scheduled to be made and a further half-percentage point jump is widely expected. The Bank’s rate increase will impact purchasing power and reduce mortgage amounts for many borrowers, further limiting the pool of eligible buyers, many of whom have been priced out due to record-high sales prices. While a rise in rates may ease competition, economists say it will worsen affordability in the months to come.

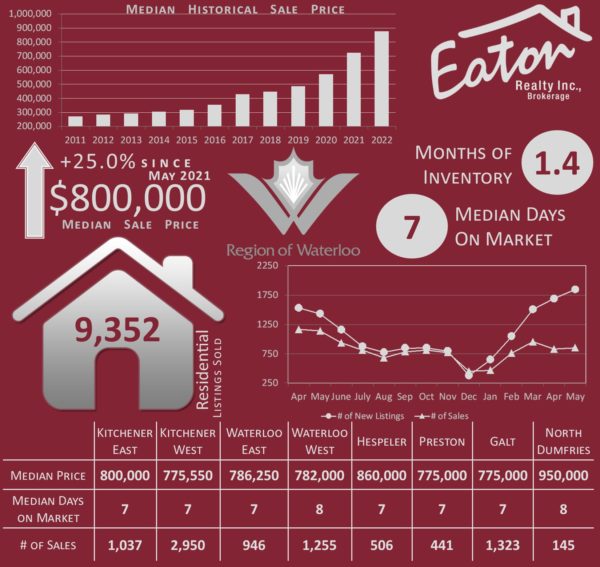

Continuing the trend of the last several months, is the divergence between the number of listings and the number of sales. If you chart these numbers in stable market conditions they follow a similar track on a line graph. As the number of listings increase, so to do the number of sales, and as listings decline in slower periods of the year so to do the number of sales. Over the past couple of months these lines have been trending in opposite directions. The number of listings is up significantly but the number of overall sales is in decline. The result is increasing inventory levels, though with a current inventory level of just over 6 weeks, we are still not seeing balanced market conditions.

This steady increase in supply is putting downward pressure on prices. The market set records in February of this year when 802 houses sold in the region for a median price of $958,206. In the months that followed a steady decline in prices has been experienced across the region, with each of the last three months seeing a decline in the median price of greater than 5%. Bringing the median sale price in May for a home in the Waterloo Region to $805,000.

While this may sound like a lot of doom and gloom, rest assured the sky is not falling. Properties that are priced appropriately are still selling, though Buyers are bringing forward increasingly less aggressive offers, many now including conditions. A prudent seller will put less weight on the factoring in of sold prices and take a hard look at the competition when creating their pricing strategy these days. Relying on sold prices in a teetering or down trending market will have you chasing the bottom. In a declining market, the first home to reposition sells for more than those who follow. You need to be out in front.

If a move has been on your mind, please reach out to us for a conversation. There are lots of factors to consider to get the timing correct these days, interest rate changes alone can make a significant difference in the overall cost of your home during the course of ownership.