The Canada housing market began the year as it ended 2022, with many buyers and sellers remaining cautious while they wait to see where the market is headed.

The Canada housing market began the year as it ended 2022, with many buyers and sellers remaining cautious while they wait to see where the market is headed.

Demand for housing persists, but inflation, higher borrowing costs, and overall prices have cut into affordability, causing market activity in the region to decline by 373 sales, down 46.7% compared to this time last year when 798 sales were posted in the month of February.

The decline in home sales continues to put downward pressure on sales prices, with the Aggregate Composite MLS Home Price Index (HPI) falling 1.6% month-over-month nationwide, marking the 9th consecutive monthly price drop, according to CREA.

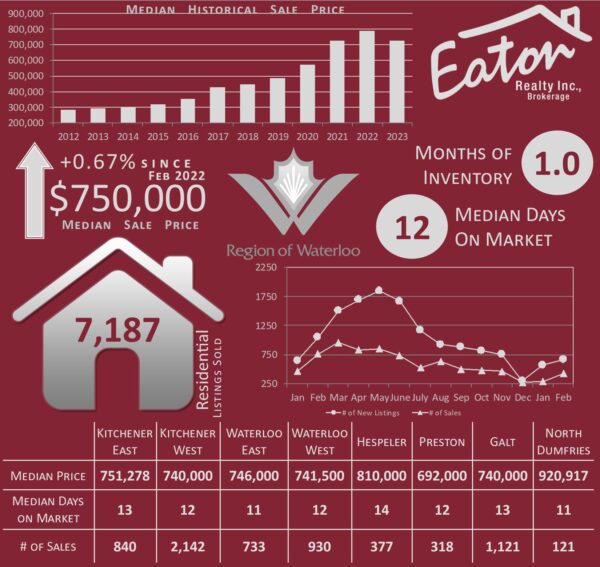

February 2022 will be remembered as a turning point in the market, during that month the median price hit its peak at $958,706 since then the region has experienced a pullback of 23.8% in the median price to $730,000 in February 2023. A staggering drop to be sure, but before we start to recite the tale of Chicken Little, the median price in February of 2021 was $717,639. Over the long term, real estate has always been and continues to be on an upward trajectory.

For Homebuyers the cost of housing remains significantly higher than it was in 2019, prior to the start of the pandemic. Borrowing costs continue to rise as the Bank of Canada attempts to tame inflation, with the key interest rate now 4.50% following the Bank’s latest quarter point increase in January. The next announcement is scheduled for March 8th.

The Canada rental market remains red hot, with the average rent for all property types up 10.9% in 2022, according to Rentals.ca January 2023 Rental Report. Year-over-year, the average listed rent for all property types rose to $2,005 as of last measure, an increase of more than 12% from the same period last year. This is the second consecutive month rent has exceeded $2,000, with the surge in rent growth attributed to low vacancy rates, population growth, and a pullback in home buying due to rising homeownership costs over the past year.

Statistics compiled from information available on the ITSO Database as of February 28, 2023. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.