The Canadian housing market continues to cool under fast-rising borrowing costs, as the central bank tightens monetary policy to help quell inflation.

In September, the Bank of Canada raised interest rates 75-basis-points to 3.25%, they added an additional 50-basis-points in their October announcement bringing the current target for the overnight rate to 3.75%. Higher mortgage interest rates have led many buyer and sellers to hold off on their plans to move causing a continued decrease in market activity with 1,666 homes selling in the Waterloo region in the last three months, down 25% from the same period in 2021.

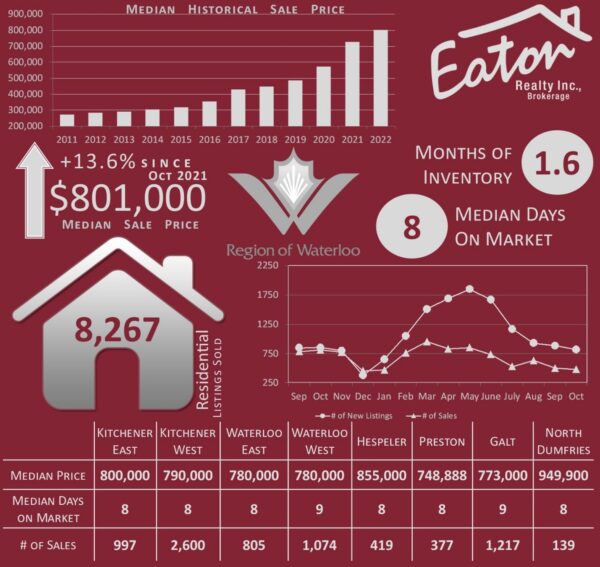

The median sale price in the region remains steady at just over $800,000 during the previous 12-month period, as it has since late spring. Other trends are also continuing, such as a steady decline in market activity. The number of new listings is down almost 4% compared to October of last year while the number of sales has plunged 40% with 331 fewer sales this October than there was in October of 2021. This less competitive market is also translating into a decrease in the list to sale price ratio. During the height of the Sellers’ market of 2020/2021 properties frequently sold for 100’s of thousands over the asking price. In fact, it was rare for a property to sell below its listed price. Over the last several months the median list to sale price ratio has continued to trend downwards and has consistently been below 100%, meaning more homes are selling at prices below asking than above.

Another number on the decline is Canada’s homeownership rate which, as of last measure, was 66.5%, down 2.5% from its peak of 69% in 2011, according to recent data from Statistics Canada. As more prospective homebuyers are priced out of the housing market, many are turning to the rental market, where the growth in renter households has far outpaced the growth of owner households.