Canada’s housing market recovery continues to gain momentum, with monthly home sales climbing 5.1% as of last measure, according to the Canadian Real Estate Association (CREA), building on the double-digit sales increase of April.

Canada’s housing market recovery continues to gain momentum, with monthly home sales climbing 5.1% as of last measure, according to the Canadian Real Estate Association (CREA), building on the double-digit sales increase of April.

The number of home sales rose 1.4% annually, representing the first national year-over-year sales increase since June 2021, capping a robust spring homebuying season following the Bank of Canada’s temporary pause on interest rate hikes earlier this year.

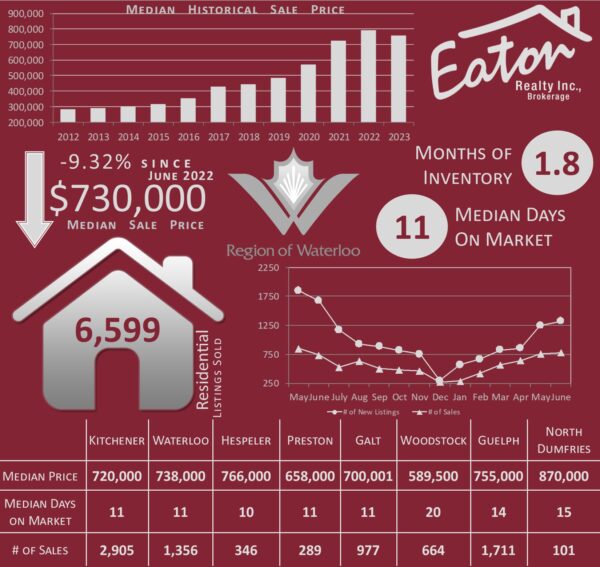

The recent boost in home sales appears to have brought some sellers off the sidelines, with the number of new listings in the region up 5.9% month-over-month. Despite the increase in listings, sales have kept pace and there is little change in the sales-to-new listings ratio. Inventory remains well below the long-term average at just 1.8 months. This low level of supply, clashing with a once again increasing demand, has got sale prices on the rise once again, with the median sale price for the previous 12 month period standing at $730,000, reversing the downward trend we have been experiencing.

Turning to new construction, southern Ontario faces similar challenges seen at the national level. Higher interest rates, persistent labor shortages, and increased construction costs are impacting Canadian homebuilders, resulting in a slowdown in new home construction. According to the Canada Mortgage and Housing Corporation (CMHC), total housing starts have declined by 23% in the past month across the country, though they still remain elevated when compared to historical standards. In our region these factors are affecting buyer affordability and contributing to the challenges faced by homebuilders.

In the Waterloo Region, the issue of affordability remains center stage with the Aggregate Composite MLS Home Price Index (HPI) climbing 8.8% from the beginning of 2023. Reversing the trend of 2022 when we saw the HPI peak in February at 486 and then decline by 24.8% by the end of last year. Days on market also saw a reversal of recent trends declining to a median of 11 days on market after peaking at 15 days in April. While the average list to sale price ratio remains steady at 103%. Most properties are still selling at or above list price, the median list-to-sale price ratio remains steady at just over 100%.

With many would be Buyers acclimatizing to our new rate reality, many are projecting the worst to be behind us. Including RBC Assistant Chief Economist, Robert Hogue, who said “”Spring 2023 increasingly looks like the turnaround point for Canada’s housing market after a year-long slump”. Local supply levels and market activity certainly support that thesis.

If you have been considering a move, please reach out to us for a conversation. There are numerous factors to consider to ensure the timing is correct in today’s market. Changes in interest rates alone can significantly impact the overall cost of your home during the course of ownership.

Statistics compiled from information available on the ITSO Database as of June 30, 2023. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.