Canada’s housing market continues to cool, as higher interest rates and affordability challenges weigh down market activity ahead of the winter months.

Canada’s housing market continues to cool, as higher interest rates and affordability challenges weigh down market activity ahead of the winter months.

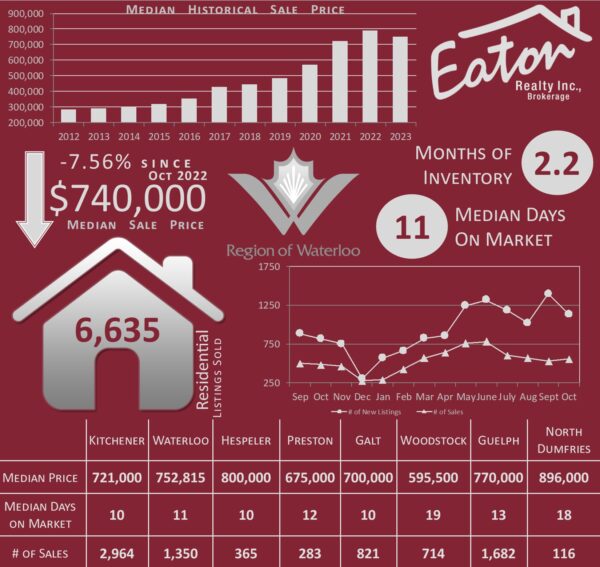

According to the Canadian Real Estate Association (CREA), national home sales fell 1.9% month-over-month as of the last measure, the third consecutive month that home sales declined, with sales down in 8 of 10 provinces. However, the number of sales in the Waterloo region ticked upwards, with the 12-month rolling average increasing 1% from last month to 6,635 sales in the region.

There were 11,415 listings during that same period. However, this number can be slightly deceptive without context, as many properties in the last year altered pricing strategies, cancelling, and re-listing the same property multiple times before securing a sale. A more accurate way to analyze the relationship between the number of listings and the number of sales is with the absorption rate, which compares the number of active property listings at a given point in time to the number of sales in a particular time period. At the end of October, the absorption rate locally was 44.9%. An absorption rate above 20% typically signals a seller’s market, and an absorption rate below 15% is an indicator of a buyer’s market.

In recent months, the slowdown in home sales coincided with a rise in new listings nationwide, with the number of newly listed properties up 6.3% from the previous month, according to CREA. New listings have increased a cumulative 35% from the 20-year low this spring. Locally however, the region bucked the trend of increasing inventory we had been experiencing through the third quarter with inventory levels declining 7.5% from last month to 2.23 month of inventory on the market.

Consumers have become increasingly sensitive to fluctuations in interest rates, with many prospective buyers putting their purchase plans on hold while they wait to see if rates will continue to rise. An interest rate increase of just 0.5% on a $500,000 means adding hundreds of dollars per month to a mortgage payment and almost $100,000 in interest over the life of the mortgage. Many of those choosing to make a purchase to get ahead of speculations of continuing home price increases are opting for shorter term mortgages, hoping for more favourable rates in the not too distant future. Others are choosing to buy down the rate on their mortgage. There are lots of options to consider in today’s mortgage market.

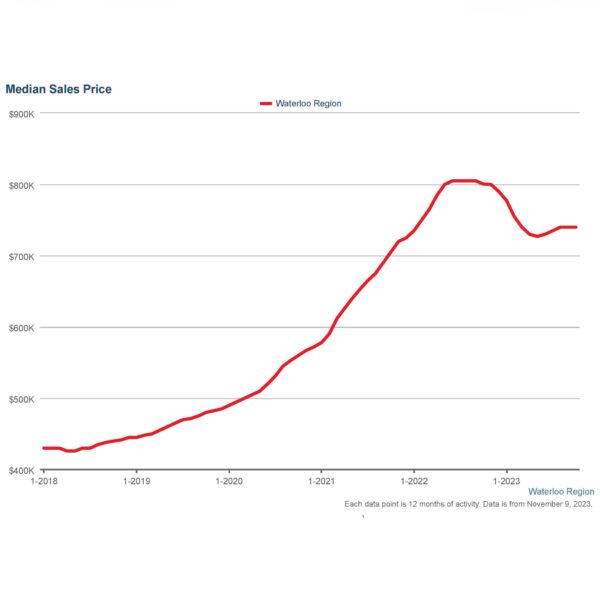

Prices have increased at a relatively steady, though very slow pace, since the low was hit in May of this year when the 12-month median sale price bottomed at $727,000. Since then, the median sale price has rebounded by an average of 0.32% per month putting us on target for a 3.8% annual increase. This number seems a reasonable prediction in the short term given our current inventory levels and economic environment. However, as we have experienced several times in the last couple of decades however, there are many factors that cannot be predicted that can dramatically and quickly change the landscape.

Downloadable Neighbourhood Reports

Galt East Galt North Galt West Grey County

Guelph Hespeler Kitchener North Dumfries

Oxford County Perth County Preston Waterloo

Wellington County Woodstock Woolwich and Wellesley

Statistics compiled from information available on the ITSO Database as of November 9, 2023. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.