Prices have appeared to level off in the most recent two quarters of 2023, but industry professionals are conflicted about what the fourth quarter will bring.

While there was no change in the number of sales in September year over year, on an annual basis, the 12 month rolling number of sales has declined sharply from its peak in the first half of 2021, hitting a low not seen in over 15 years and down 23.6% since this time last year.

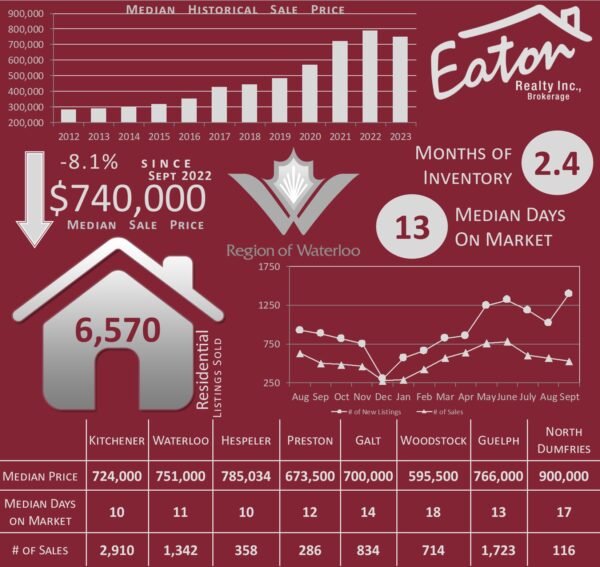

New listings are headed in the opposite direction, with 1,400 new listings this September, more than that month has seen in over a decade and a 52% increase from September of 2022. The result of this declining number of sales and increasing number of listings is obvious: increasing inventory levels. Inventory levels jumped 85% year over year in September, hitting the highest monthly supply level since October of 2015. Though it is important to remember that while buyers may have additional options in their home search, inventory remains low by historical standards, with only 2.6 months’ supply heading into October. It is still a seller’s market, though not as strong as it has been over the last several years; however, multiple offers are still commonplace.

Economists had predicted that sales would soften after the mortgage rate hikes we experienced this summer, which saw the benchmark interest rate rise to 5%, a 22 year high. These rates did push some prospective buyers back to the sidelines, while remaining buyers face significantly higher monthly payments.

So the question is, what will buyers do? Will high interest rates make carrying costs at current pricing unaffordable and keep would be buyers on the sideline putting downward pressure on pricing? Or, will this increase in inventory spur market activity and have buyers shift strategy to get in the market with shorter term mortgages hoping for relief from the rates on renewal. Only time will tell.

In the rental market, asking rents in Canada hit yet another high recently, reaching $2,117 per month as of last report, according to Rentals.ca. Over the last three months, national asking rents increased by 5.1%, or an average of $103 per month. Although apartment completions over the last 12 months are at their highest level since the 1970s, rental prices have continued to rise nationwide due to increased demand stemming from a decline in homeownership affordability and Canada’s record-high population growth.

Downloadable Neighbourhood Reports

Galt East Galt North Galt West Grey County Guelph

Hespeler Listowel Kitchener North Dumfries Oxford County Preston

Waterloo Wellington County Woodstock Woolwich and Wellesley

Statistics compiled from information available on the ITSO Database as of October 5, 2023. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.