The real estate market in the region started 2023 at a significantly slower pace than usual. In January, the number of property sold plummeted by 43.6% year over year, and inventory remained limited due to a sharp decline in new listings.

The real estate market in the region started 2023 at a significantly slower pace than usual. In January, the number of property sold plummeted by 43.6% year over year, and inventory remained limited due to a sharp decline in new listings.

Prices continued their downward trend, but affordability challenges were exacerbated as interest rates rose, compelling numerous buyers and sellers to step back from the marketplace.

Towards the end of the first quarter, inflation started to recede, leading the Bank of Canada to declare a pause in interest rate hikes. As the spring market unfolded, enthusiastic buyers entered the scene, boosting demand, and the number of listings and sales experienced an upturn, reaching its peak by the end of the second quarter. During the second quarter, prices hit their lowest point, bottoming in May 2023, at a median price of $726,500.

In the summer, inventory began to rise, reaching its peak in September before gradually declining through the fall. Entering the third quarter of 2023 the 12-month rolling median price reversed trend and began a slow climb through to the end of the year, culminating in a median sale price for the year of $742,500.

The Bank of Canada made its final rate hike of the year in July, raising the benchmark rate to 5%, a 22-year high. The combination of high interest rates and soaring housing costs has led to affordability challenges affecting numerous households. This trend is expected to persist through at least the first half of 2024, as analysts anticipate that relief from the Bank of Canada, in the form of rate cuts, is unlikely until at least then.

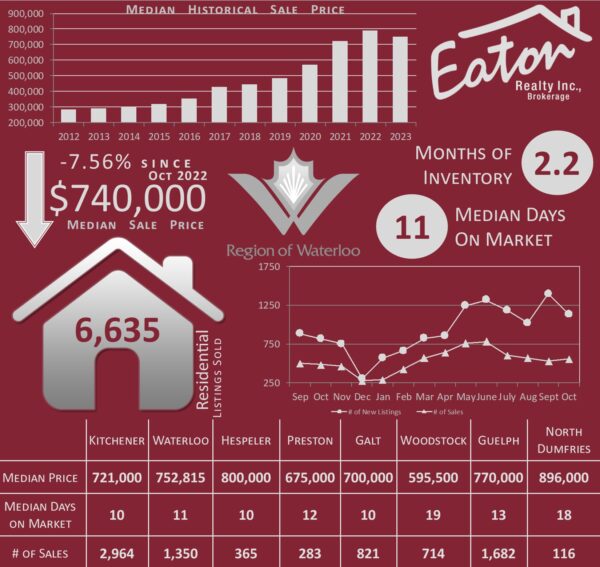

Sales: Sales were down 14.8 percent to finish the year at 6,623 units.

Prices: Median home price is down 6% from 2022 to $742,500. Single Family home prices ended the year down 6.7% year-over-year, with a median sale price of $840,000 and attached homes declined 8.8% to a median sale price of $592,250.

Listings: 11,528 listings were entered into MLS for the region in 2023, a 14.5% decline from 2022.

Inventory: 982 properties in the region were on the market to end 2023, a 14% increase from the end of 2022.

2024 Predictions:

Many economists predict that we have reached the end of the rate-hiking cycle from the Bank of Canada, anticipating rate cuts in 2024, though likely not until at least the third quarter. In the meantime, inventory is expected to remain tight, and affordability challenges will persist, impacting home sales. Home pricing predictions for 2024 vary; while some regions are likely to see more downside, most forecasts indicate that prices, on the whole, will either hold steady or experience modest increases. This scenario is likely to contribute to a continued competitive rental market in the months ahead.

Downloadable Neighbourhood Reports

Galt East Galt North Galt West Grey County

Guelph Hespeler Kitchener North Dumfries

Oxford County Perth County Preston Waterloo

Wellington County Woodstock Woolwich and Wellesley

Statistics compiled from information available on the ITSO Database as of January 7, 2024. The Median Historical Sale Price in the graphic represents year-to-date value. All other values represent a 12 month rolling.